DSCR Loans Tucson – Invest Smarter with No Income Verification

Arizona real estate continues to offer significant opportunities for both new and seasoned real estate investors. The Joe's My Lender Team at Patriot Pacific, we provide Debt Service Coverage Ratio (DSCR) loans in Arizona designed specifically for investors seeking fast, efficient financing without traditional income verification. This guide explores the key features, benefits, qualifications, and how to leverage DSCR loans to build or scale your investment portfolio in the Grand Canyon State.

What Is a DSCR Loan?

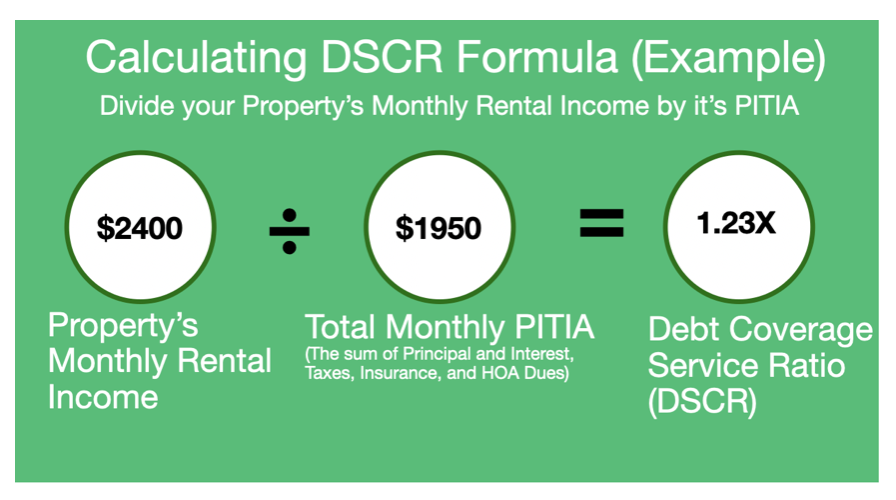

Unlike a Conventional Loan, DSCR (Debt Service Coverage Ratio) loans are asset-based mortgages that evaluate property cash flow instead of borrower income. This allows real estate investors to qualify for loans using rental income rather than tax returns, W-2s, or pay stubs. Try our DSCR Loan Calculator below

DSCR Loan Calculator

Why Arizona Investors Use DSCR Loans

No Personal Income Verification

DSCR loans qualify based on property cash flow, not personal income, making them ideal for investors with complex tax situations or multiple income streams.

Faster Approval Process

Without extensive personal financial documentation, DSCR loans typically close faster than traditional investment property loans, perfect for competitive Arizona markets.

Scale Your Portfolio

Build wealth through multiple investment properties without hitting traditional lending limits based on personal debt-to-income ratios.

Arizona Market Advantages

Strong rental markets in cities like Tucson, Phoenix, and Sierra Vista make it easier to achieve the 1.0+ DSCR ratio needed for loan approval.

Flexible Borrower Types

Perfect for self-employed investors, real estate professionals, or anyone whose personal income doesn't reflect their investment capacity.

Competitive Rates

Despite being non-QM loans, DSCR products offer competitive rates for qualified investment properties with strong cash flow.

Ready to Grow Your Arizona Investment Portfolio?

Discover how DSCR loans can help you acquire your next investment property without the hassle of traditional income verification.

Ready to ApplyFrequently Asked Questions for DSCR Loans in Arizona

Why Choose Joe's My Lender Team for Arizona DSCR Loans?

We are a mortgage broker with direct access to DSCR loan investors, offering tailored loan structures, competitive rates, and rapid closings. Whether you're buying your first duplex in Tucson or refinancing a short-term rental in Green Valley, we have the experience to guide your investment journey.

Who Should Use a DSCR Loan?

- Self-Employed Investors

No tax return headaches. - Gig Workers or 1099 Contractors

No W-2s needed. - Seasoned Real Estate Investors

Scale quickly with cash-flowing properties./li> - First-Time Investors

Great for purchasing a first rental property if DSCR qualifies.

Give Joseph Small and team a call today to see if a DSCR loan might be right for you.

Ready to Invest in Arizona? Let's Get You Pre-Qualified

The Arizona investment market is too good to wait. If your property cash flows, you may already qualify. Connect with our team today and get pre-qualified for a DSCR loan in Arizona — no tax returns required.